This is the first post for my monthly financial progress report. I only have very small amount of money as of now and this will be reflected in this report. It does not matter how small I have now but what is important is I have started off something.

First Monthly Progress Report

I was contemplating of whether to publish this or not. I am really hesitant to share my numbers . However, I started this blog purposely to track my financial life’s journey, so I finally decided to do this.

First off, here are some facts about my financial life:

- I have a small house taken on a loan and I am still paying for its mortgage now.

- Aside from my mortgage, I have an insurance that I am still paying for as well.

- My monthly expenses revolve around my monthly house mortgage, insurance fees, minimal credit card bills for this website, utility bills, food, transportation and occasional petty expenses.

- I have no existing debts other than my house mortgage.

- I am an ordinary employee that earns a small amount of salary which borders to poverty line 0-:

My financial goal

- Save aggressively and build up passive income.

- That passive income must eventually be sufficient enough to cover our needs and expenses.

- My planned vehicles to financial independence are savings, cooperatives, mutual funds, stock market and real estate.

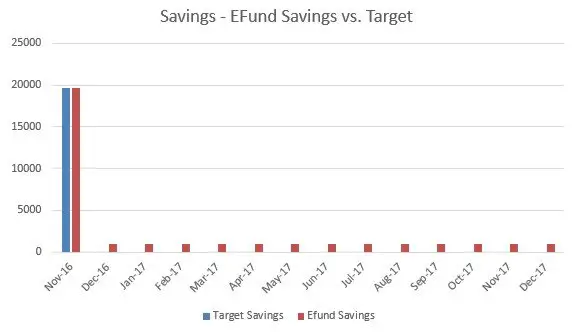

November 2016 Financial Report

I am going to share my numbers that are earning. As of the moment, I only have few savings for emergency fund and a small amount for my child’s education fund which I top-up a small amount every month.

The graph above is the presentation of the educational fund that I save for my child. As of November, the savings is only at P19,700. One of the expenses that I really dread come enrollment time is the school fees. I started saving last year for this fund. I saved just small amount on a regular basis and hopefully it can accumulate over time. This fund is intended to help me up for the schooling of my child.

This fund is a savings fund placed in a cooperative. This earns an annual interest of 10-16% depending on the performance of the cooperative.

Cooperative savings are tax-free that is why I placed this fund in it.

That’s it for now folks. Happy saving, happy investing!

Trackbacks/Pingbacks