The new year ushers fresh start and it is the best time to set out your financial resolutions to hit your money goals for the year and hopefully improve your financial life for the better.

The new year brings so much hope and joyful vibes that it is the best time to set new financial resolutions to have a better head start for the beginning year.

1. Set out financial goals

It is best to write down your financial goals and jot down ways you can achieve them. You will achieve far much better than not having and writing your financial goal at all.

Goals will serve you as a guide to the financial direction that you want to be in the future. Do not forget to make your goals and plans SMART – specific, measurable, achievable, relevant and time-bound.

2. Write down your budget and stick to it

If you are trying to achieve something financially, it is best to know where your money is going to. The best way to have this information is by having a budget set and track your expenses.

You may review your expenses against your budget and see what expenses are unnecessary and you can cut back that off. That way you can save some of your money and see to it that you are putting your money only to things that really matter and give value to your life.

However, always remember that having a budget is useless if you are not sticking to it. So, have the discipline to set your budget, stick to it, review it on a regular basis.

3. Build your emergency fund

The past few year/s have been challenging and you might have used up some if not all, your emergency fund. If you have not used up your emergency fund, then great.

However, if you depleted your e-fund, make it a priority to replenish it. With the devaluation of money and high inflation rate, it is best to review your emergency fund figures and maybe strengthen it some more. Of course, that depends on your personal financial situation.

4. Increase Savings

Savings is necessary so that you will have funds that you can eventually invest. You can find various ways to save money in different areas of your life.

You may check out this article on ways you can save money, from food, transportation, electricity and others.

5. Pay-off Debt

One of the financial resolutions that you need to get your attention is debt repayment. That is especially true if its consumer debts like credit card.

The rule of the thumb when paying debt is to always start with the ones that carry high interest rate then work your way down until you pay off all your consumer debts.

6. Increase income

One of the ways that gives you financial freedom and will enable to speed up your financial plans is to increase your income. You can do side hassles aside from your day job.

This way, you can increase your savings and be able to have investable funds that will generate passive income in the future.

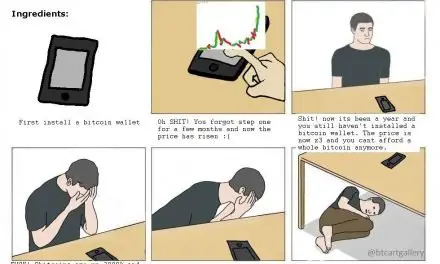

7. Invest Wisely

No matter how big your income, if you do not invest wisely, you will always go back to square 1. It is said that if earning money is hard, growing it and investing it is way harder.

However, with knowledge and research, you can make informed decisions on where to put your money and ride on investment vehicles that give you the best reward.

You have actually a number of options when it comes to investments. You can invest in stocks, index fund, dividend funds and real estate properties that generate income.

8. Be active and stay healthy

It may sound a cliche but the saying ‘Health is Wealth’ is so true. No matter how huge your money, if you are not healthy then it is good to nothing if your health is failing.

Make part of your financial new year resolutions your health – physical and mental health.

It is time to eat better and healthy. You can do simple but helpful exercises or even a simple walking would be a great help for your health.

Above all, keep your mental health a priority. If you are feeling overwhelmed, take time to relax and slow down and enjoy life’s precious moments.

Key Takeaways

Experiencing the new year is a blessing in itself. Not all have reached this far.

New year is the best time to set new plans and goals. It is also a fitting time to make resolutions especially in the area of your financial life.

Always remember that it is always best if you set your resolutions and have plans to better the future, than not having it at all.

At least, if you fail to achieve all your resolutions, you will definitely be in a better position.

Happy New Year and cheers to better financial life folks!