When it comes to investing, there are a lot of options to choose from. You can invest in stocks, bonds, real estate, and more. But how do you know which investment is suitable for you? And how do you make sure that your money is working for you?

This blog post will explore the different types of investments available, discuss which ones might be best for you, and how to manage your investments and keep them on track with your financial goals.

So, whether you’re just starting out in the world of investing or you’re looking for new ways to grow your portfolio, read on!

1) Stocks:

When most people think of investing, stocks are the first thing that comes to mind. This is because stocks represent ownership in a company and provide investors with a share of the profits or dividends.

Investing in stocks can be risky but also has the potential for high returns over time. In addition, investing in stocks can provide diversification to your portfolio and help protect against inflation.

2) Bonds:

Bonds are a type of debt investment where an investor lends money to a company or government for a fixed rate of return. Bond investments tend to be less risky than stock investments as the return is guaranteed, but they also typically offer lower returns over time.

Furthermore, bonds can be used to hedge against inflation which can help preserve your purchasing power.

3) Real Estate:

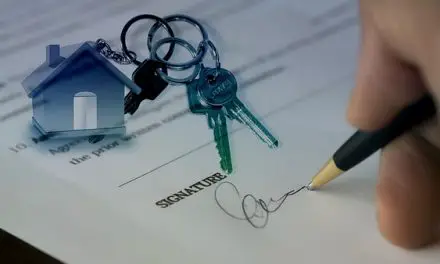

Real estate is another famous avenue for investing. Real estate investments can range from residential and commercial properties to REITs (real estate investment trusts).

Investing in real estate offers a variety of benefits, such as potentially higher returns over time, tax advantages, and the ability to leverage your assets, especially if you invest in the rights areas such as zoomproperty.com/en/buy/dubai/apartments-for-sale-dubai-marina, which is one of the most prominent real estate markets in Dubai.

It’s crucial to remember that when you decide to invest in property you will make use of a licensed real estate broker. Remember that real estate investments are highly illiquid and come with more risks than other types of investments

4) Mutual Funds:

Mutual funds are another popular option for investors who don’t want to pick individual stocks and bonds. Mutual funds are a collection of different investments that a professional fund manager manages.

They offer investors the ability to diversify their portfolio with just one investment, which can help reduce risk and provide higher returns over time.